5 Factors That Determine if You'll Be Approved for a Mortgage,

1. Your credit score.

Your credit score is determined based on your past payment history and borrowing behavior. When you apply for a mortgage, checking your credit score is one of the first things most lenders do.

2,Your debt-to-income ratio.

Your debt-to-income (DTI) ratio is the amount of debt you have relative to income -- including your mortgage payments.

3.Your down payment.

4.Your work history.

Typically, lenders want to see that you've worked for at least two years and have steady income from an employer. If you don't have an employer, you'll need to provide proof of income from another source, such as disability benefits.

5.The value and condition of the home

Finally, lenders want to make sure the home you're buying is in good condition and is worth what you're paying for it.

Of Course, If you find this a hassle, you can seek the help of professional loan brokers and professional loan companies.

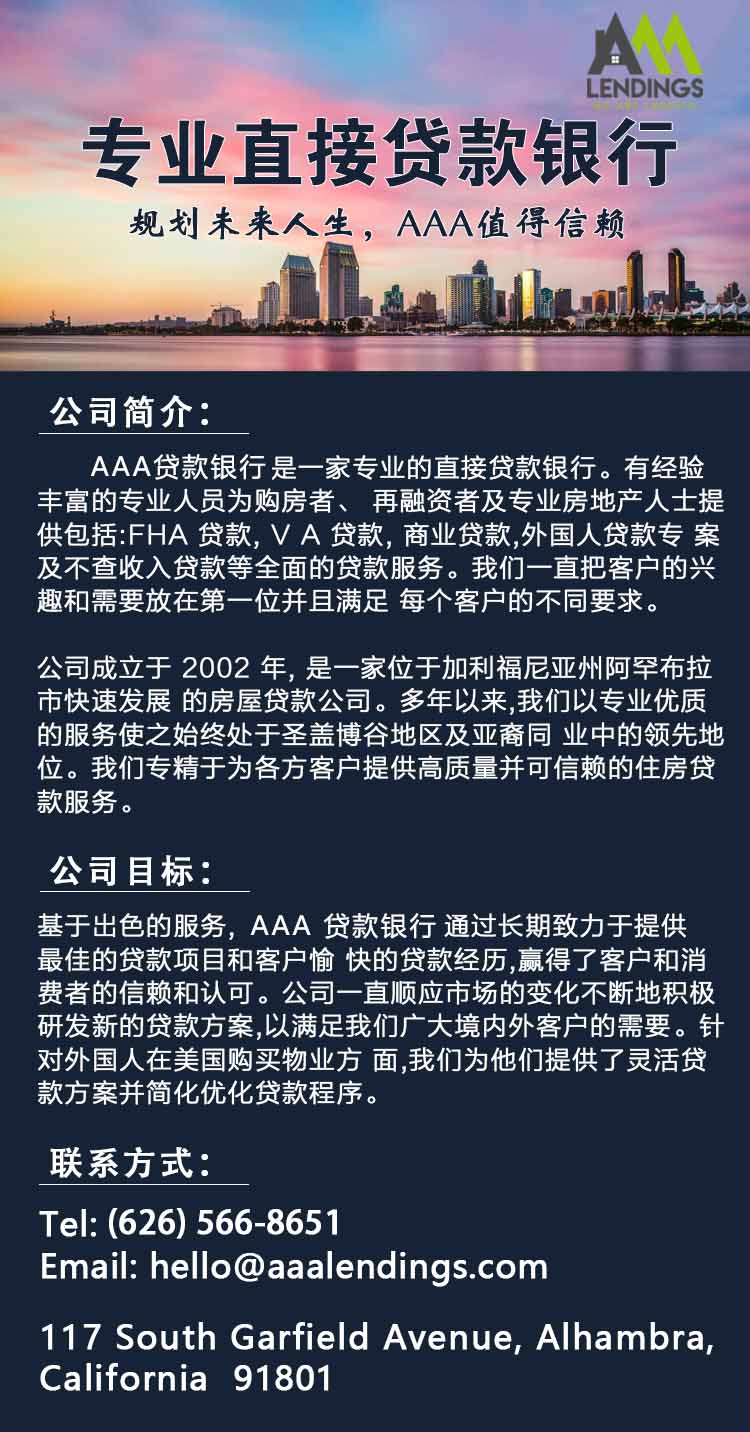

AAA Lendings is a direct mortgage lender with over 20 years of lending experience. We have a group of experienced professionals providing services for home buyers and people with mortgage needs. We offer 100+ customized loan programs in conventional, FHA, VA, EZ qualified and foreigner nationalloans. We always put customer's needs first and provide the best customized solution for each customer.

Mortgage lenders in California,best mortgage lenders for first-time buyers,Best Mortgage companies to work for in California, Non-QM mortgage loans to borrowers in California,non-QM loans lenders, best Jumbo loans lenders, Jumbo mortgage loans lenders, Best Mortgage Refinance Lenders aaalendings

阅读原文 阅读 903